Annuity factor formula

Future Value of an Annuity. An annuity dues future value is also higher than that of an ordinary annuity by a factor of one plus the periodic interest rate.

What Is An Annuity Table And How Do You Use One

As illustrated b we have assumed an annual interest rate of 10 and the monthly EMI Installment for 30 years.

. How Good a Deal Is an. To calculate present value the k-th payment must be discounted to the present by dividing by the interest. 1 find r as 1 115.

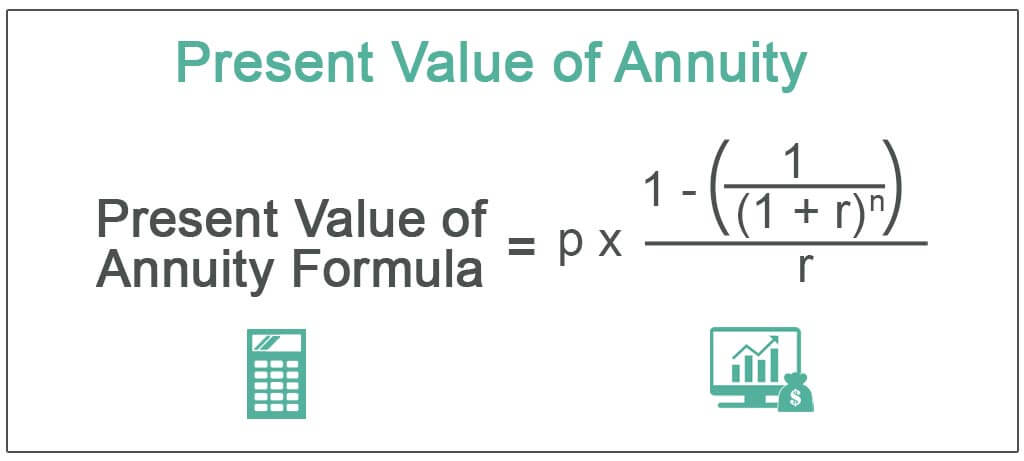

Present Value of an Annuity. An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization pay out a stream. The formula can be expressed as follows.

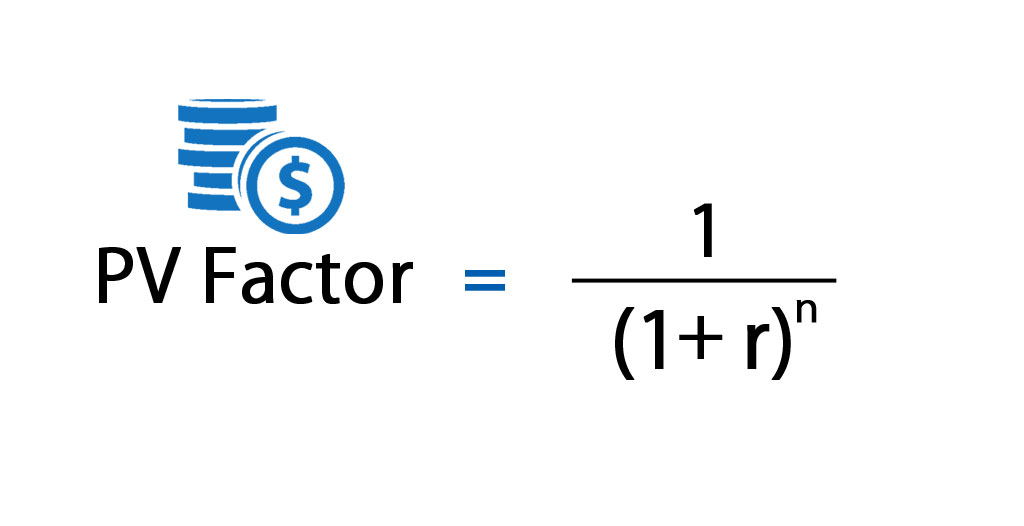

An annuity factor is a constant value used to calculate the present value of future annuity payments. For example an individual is wanting to calculate the present value of a series of 500 annual payments for 5 years based on a 5 rate. Deciding whether money in hand or an annuity payment later is of greater value is complicated due to the time value of money.

An annuity is a series of payments made at equal intervals. This is the present value per dollar received per year for 5 years at 5. Rate Per Period As with any financial formula that involves a rate it is important to make sure that the rate is consistent with the other variables in the formula.

Anil Kumar deposits 1000 at the beginning of each year for the period of 3 years and the discount factor of 5. Calculate the present value of Annuity Due using the following information. The last difference is on future value.

Examples of Present Value of Annuity Due Formula With Excel Template. FV of an Annuity Due FV of Ordinary Annuity. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date.

Meaning Formula and Example. By looking at a present value annuity factor table the annuity factor for 5 years and 5 rate is 43295. While it can be calculated its easiest to look it up in a table.

Find PVOA factor as. The formula for future value FV is FV PV x. Each cash flow is compounded for one additional period compared to an ordinary annuity.

Present Value Interest Factor of Annuity PVIFA 20 of 35. Proof of annuity-immediate formula. Present Value Factor Formula in Excel With Excel Template In this example we have tried to calculate a present value of the Home Loan EMI using the PV factor formula.

Installment amount assumed is Rs.

Future Value Annuity Due Tables Double Entry Bookkeeping Time Value Of Money Annuity Table Annuity

Annuity Payment Factor Pv Formula With Calculator

Present Value Annuity Factor Formula With Calculator

:max_bytes(150000):strip_icc()/FVAnnuityDueCalculation1-4d12243b371244199e020426d698a592.jpg)

Annuity Due Definition

/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Annuity Due Definition

Future Value Of Annuity Formula With Calculator

Pv Of Perpetuity Formula With Calculator

Annuity Formula What Is Annuity Formula Examples

Annuity Present Value Pv Formula And Calculator

Present Value Of An Annuity How To Calculate Examples

Present Value Of An Annuity Definition Interpretation

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Annuity Due Definition

Present Value Factor Formula Calculator Excel Template

Future Value Of An Annuity Formula Example And Excel Template

Present Value Of Annuity Formula With Calculator

Present Value Of An Annuity How To Calculate Examples

:max_bytes(150000):strip_icc()/NPVFormula-5c23ea8f46e0fb00013d2624.jpg)

Net Present Value Vs Internal Rate Of Return